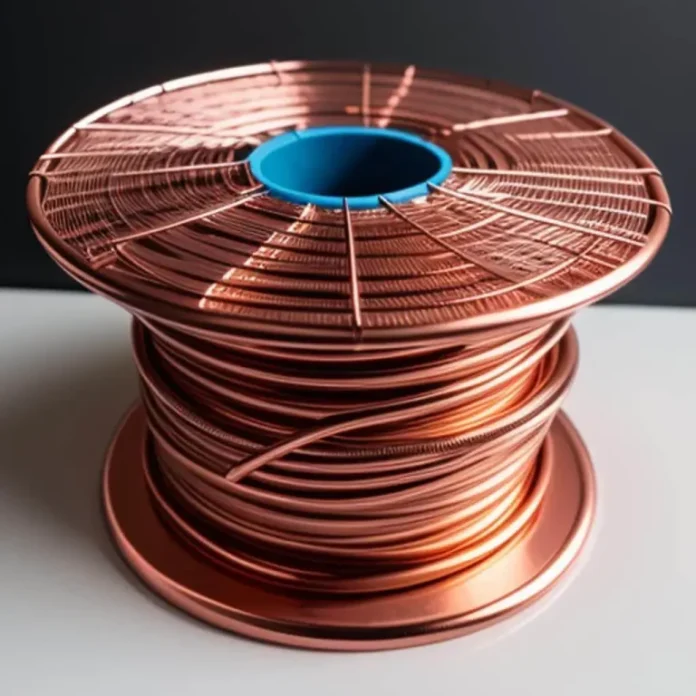

Latest Copper Rate in Pakistan Today and scrap copper are given below in the table. We have also mention copper price per kg and copper price per matric ton.

Today Copper Rate in Pakistan

Copper, an essential industrial metal, plays a significant role in Pakistan’s economy. From infrastructure to electrical goods, the demand for copper influences various sectors. Understanding the current copper rate in Pakistan is crucial for businesses and investors alike. This article delves into the latest copper prices, factors affecting these rates, and future market trends.

| Copper Type | Rate Per KG | Rate Per Ton |

|---|---|---|

| New Copper | Rs.3100 to 3200 | Rs.31,00,000 to 32,00,000 |

| Scrap copper | Rs.2100 to 2200 | Rs.21,00,000 to 22,00,000 |

Top Copper Brands in Pakistan

- Musleh Trading

- Ganar International

- Pearl Cables and Conductors

- PM Engineering

- Future Traders

- Orient Trading Company

- Ali and Company

- Atta Steel and Copper Industries

- Bushra Enterprises

- Mian Mohammad Feroze and Sons Enterprises

- Petro Sourcing

- Mirza Traders

- System Electrical and General Equipment

- Maaz 360 Private Limited

- Copper World

- MM Enterprises

- Trading Strings

Current Copper Rate in Pakistan

As of today, the price of copper in Pakistan fluctuates between PKR 1,200 to PKR 1,400 per kilogram. These rates vary depending on the quality and form of copper, whether it’s in raw form, processed sheets, or finished goods. It’s important to keep a close eye on daily market updates as these prices are subject to change based on several dynamic factors.

1 tola gold price in Lahore today

Factors Influencing Copper Prices in Pakistan

Global Market Trends

The global market heavily influences the copper rate in Pakistan. International supply and demand, geopolitical events, and economic policies of major copper-producing countries such as Chile, Peru, and China directly impact the local prices. A surge in global demand or supply chain disruptions can lead to significant price fluctuations.

Local Demand and Supply

The local market demand and supply dynamics also play a critical role. Pakistan’s burgeoning construction industry, coupled with the growth in electrical and electronics manufacturing, has heightened the demand for copper. Conversely, any disruption in local supply chains, such as strikes or logistical issues, can cause price volatility.

Exchange Rates

The exchange rate between the Pakistani Rupee and major currencies like the US Dollar significantly affects copper prices. A weaker rupee makes imports more expensive, thereby raising the local cost of copper. Conversely, a stronger rupee can help stabilize or reduce prices.

Government Policies and Tariffs

Government regulations, including import duties, tariffs, and taxes, also impact the copper rate. Any changes in these policies can lead to immediate effects on pricing. For example, an increase in import duties on copper can raise costs for manufacturers, who may pass these increases onto consumers.

Impact of Copper Prices on Different Sectors

Construction and Infrastructure

The construction industry is one of the largest consumers of copper. It is used extensively in electrical wiring, plumbing, and roofing. Fluctuations in copper prices can significantly affect construction costs. Higher copper prices can lead to increased project costs, affecting both public infrastructure projects and private real estate developments.

Electrical and Electronics Industry

Copper is a crucial component in electrical and electronic products. Its excellent conductivity makes it ideal for wiring and components. As such, changes in copper prices can impact the cost of manufacturing electrical goods, from household appliances to industrial machinery.

Automobile Industry

The automobile industry also relies heavily on copper for various parts and systems, including electrical wiring, motors, and batteries. Rising copper prices can lead to higher production costs, which may be passed on to consumers in the form of higher vehicle prices.

Strategies to Mitigate Copper Price Volatility

Hedging

Businesses can use hedging strategies to protect against price volatility. This involves using financial instruments such as futures contracts to lock in prices for future purchases, providing stability and predictability in costs.

Diversification

Diversifying suppliers can help mitigate risks associated with supply chain disruptions. By sourcing copper from multiple suppliers, businesses can reduce the impact of any single supplier’s price increase or supply shortage.

Technological Advancements

Investing in technological advancements can also help. For example, developing alternative materials or improving recycling processes can reduce reliance on raw copper and help manage costs more effectively.

Future Trends in Copper Prices

Green Energy Initiatives

The global push towards green energy is expected to drive significant demand for copper. Copper is essential for renewable energy technologies such as wind turbines, solar panels, and electric vehicles. As these industries grow, the demand for copper is likely to increase, potentially driving prices up.

Urbanization and Infrastructure Development

Continued urbanization and infrastructure development in emerging economies, including Pakistan, will sustain the demand for copper. Large-scale projects such as smart cities and enhanced public transportation systems will require substantial copper inputs.

Technological Innovations

Technological innovations in mining and recycling are expected to influence future copper supply. Advances in mining technologies can increase production efficiency, while improved recycling methods can boost the supply of secondary copper, helping to balance demand and supply.

Conclusion

Staying informed about the copper rate in Pakistan is essential for businesses and investors involved in industries reliant on this versatile metal. By understanding the factors that influence copper prices and adopting strategies to mitigate price volatility, stakeholders can make more informed decisions and better manage their costs.